We often get questions on the recently published Cayman Islands’ National Risk Assessment (NRA). These are set out below, along with the answers. Claritas principals are also happy to answer your questions about the NRA and assist with entity level risk assessments, taking into account all relevant factors including the NRA.

What is a National Risk Assessment?

The Financial Action Task Force expects all countries to understand their risks of money laundering, terrorism financing and proliferation financing, in order to be able to mount defenses proportionate to the magnitude of the risk. To discharge this expectation, all countries periodically conduct National Risk Assessments.

To satisfy this recommendation, in early 2021, the Cayman Islands issued a new assessment of the country’s money laundering, terrorism financing and proliferation financing risks. All relevant financial businesses in the Cayman Islands must understand this document and incorporate it into their day-to-day AML/CFT/CPF compliance activities.

Is this the First Risk Assessment of the Cayman Islands?

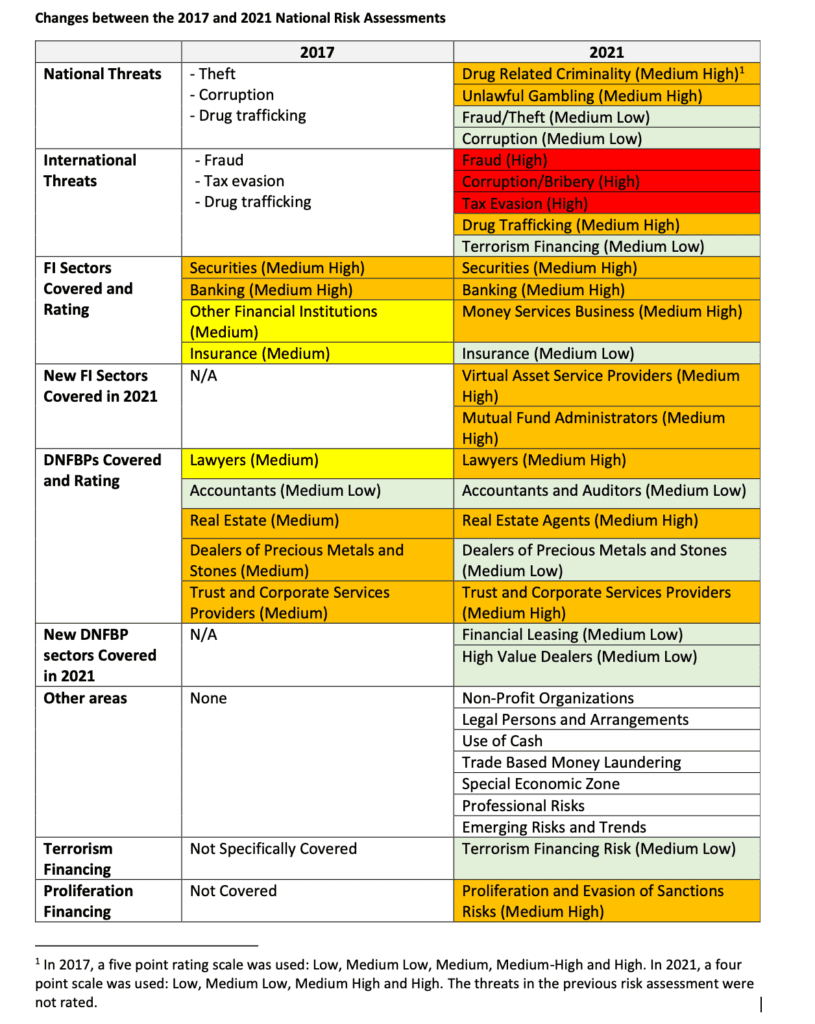

No. The Cayman Islands carried out its first national risk assessment in 2015-2017. A summary of the findings was published in 2017. However, the 2021 NRA is radically different from the first national risk assessment.

Why does this matter to Financial Institutions and DNFBPs?

The Anti-Money Laundering Regulations require all relevant financial businesses in the Cayman Islands to carry out a risk assessment of the ML/TF/PF risks in their business.

The Regulations state that this risk assessment must be kept up to date. Entities’ risk assessment should also be consistent with the latest NRA and any sector risk assessment issued by Cayman Islands regulators.

What has changed since the last NRA?

In two words: A LOT!

The table below shows the key differences between the 2017 and 2021 National Risk Assessments.

The 2021 NRA uses a different methodology, is based on comprehensive data, and incorporates new sectors and risk areas (for example, VASPs and Non-Profit Organisations).

New threats have been identified for the Cayman Islands, from domestic and international origins. The threats have also been risk rated. This change in the threat assessment requires relevant financial businesses to ensure they are familiar with typologies and red flags that are indicative of these threats.

Terrorism financing and proliferation financing risks for the Cayman Island are also assessed in the new NRA.

What do I do now?

All relevant financial businesses in the Cayman Islands should read the 2021 National Risk Assessment carefully and review their own business risk assessment to ensure that it incorporates:

– The most up to date threats to the jurisdiction

– The new risk rating for certain sectors

– Risk ratings for new sectors added in 2021

– A terrorism financing risk assessment

– A proliferation financing risk assessment

Claritas Compliance can Help

Claritas Compliance principals have significant experience in carrying out risk assessments, including the 2021 NRA. We can assist relevant financial entities with carrying out their business risk assessment and provide training on the NRA and the risk assessment process. If you would like to find out more about the impact of the NRA on your business or have a chat about how we can help, please get in touch with Justine or Elisabeth.